Magnifying Single-Stock Volatility

6/26/2025 - By Wes Crill, PhD, Senior Client Solutions Director and VP, Kevin Green, PhD, Head of Investment Solutions Analytics and VP

It’s been a couple of years since the emergence of single-stock exchange-traded funds which, as the name suggests, provide exposure to a single stock. A number of these have focused on Magnificent 7 stocks, likely providing a nauseating recent experience given the disappointing start to the year for those stocks.(1) Some of these ETFs even offer leveraged exposure, amplifying gains when the stocks go up but, as would be the case in 2025, deepening losses when those stocks decline.(2)

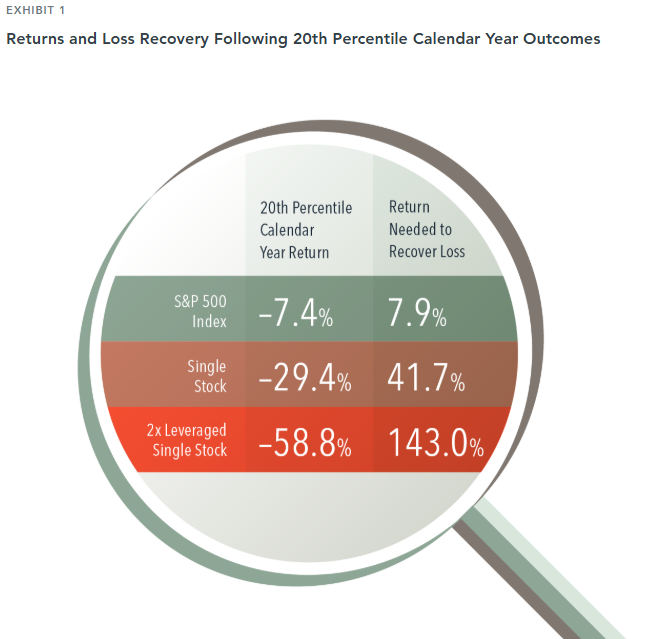

Single stocks tend to be more volatile than a broadly diversified portfolio. The 20th percentile return outcome in a single year for all US stocks, when viewed individually, was historically –29.4%. That’s 22 percentage points worse than the 20th percentile year for the S&P 500 Index, at –7.4%. The hole dug by the single-stock outcome requires a far greater surge to overcome: a 41.7% return to recover the initial loss, compared to just 7.9% to make up for the broad market’s decline.

Adding 2x leverage to the 20th percentile single-stock outcome doubles the trouble. The –29.4% drop would have become –58.8%, requiring a whopping 143% return to claw back the loss.

These scenarios show why broad diversification can help provide more reliable outcomes over time. A global equity market allocation includes potentially thousands of stocks, mitigating the impact any individual security can exert on one’s portfolio.

Past performance is not a guarantee of future results. Actual returns may be lower.

Related Posts

- Financial Scams are Evolving

- Saltmarsh Financial Advisors Earns World-Class Client Satisfaction

- The Final Chapter of the Estate Plan

- What to Know Before Year-End

- How to Prepare for a Spouse's Passing: Practical Steps for Peace of Mind

- Inside Saltmarsh's Level Up

- What to Do After a Windfall? Steps to Financial Security

- Tax Law Impacts: One Big Beautiful Bill Act

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm

- Estate Planning Essentials

- Magnifying Single-Stock Volatility

- Markets Look Forward. So Should Investors.

- Father's Day: Money Lessons Learned From Dad

- Why You May Need a Revocable Trust

- Cost of Index Reconstitution: Index & Diversification Portfolios

- Three Tips for Riding Out the Ups and Downs: Investment Trends

- Bearish Sentiment: Investment Trends

- Tariffs and Stagflation

- How Extreme was Recent Large Growth Outperformance?

- Tariff Trepidation

- Alphabet Soup of Estate Planning

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- View All Articles